TDS

As per the Finance Act 2023-24, 30% TDS will be deducted from all positive net winnings in the current financial year.

What’s New?

- Pay TDS only on net winnings.

- TDS will be deducted from the net winnings included in the withdrawal amount at the time of withdrawal and/or at the end of the financial year (FY).

Note: This policy is subject to change depending on any further directive issued by the Government of India.

Learn about the 2023-24 FY end

TDS settlement

What does it mean for players?

Players have to pay 30% TDS only on positive net winnings.

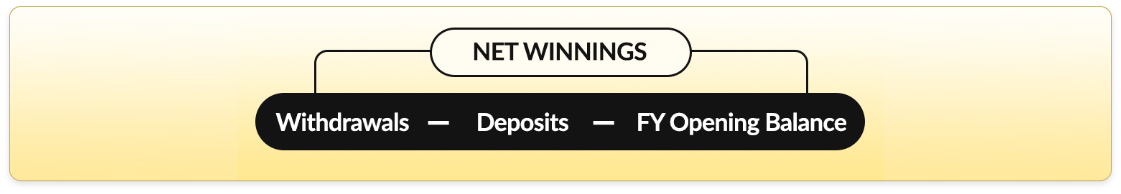

Here is the formula to calculate net winnings:

Understanding Key Terms

- Withdrawals: Current Withdrawal + previous withdrawals made in the current FY.

- Deposits: Total amount deposited into the account by the player in the current FY.

- FY Opening Balance: Total account balance (deposit + withdrawable) on 1st April, i.e. at the start of the current FY.

*Financial Year (FY) = 1st April to 31st March

Scenario 1: A player places the 1st withdrawal request for ₹10,000 in the financial year.

| Amount the player wants to withdraw (A) | ₹10,000 |

| Deposit made by player (B) | ₹3,000 |

| FY Opening Balance, on 1st April 2023 (C) | ₹5,000 |

|

Net Winnings ( A − B − C) |

₹2,000 |

| 30% TDS on Net Winnings | ₹600 |

| Player will get | ₹9,400 |

Scenario 2: A player places the 1st withdrawal request for ₹5,000 in the financial year.

| Amount the player wants to withdraw (A) | ₹5,000 |

| Deposit made by player (B) | ₹3,000 |

| FY Opening Balance, on 1st April 2023 (C) | ₹5,000 |

|

Net Winnings ( A − B − C) |

-₹3,000 |

| 30% TDS on Net Winnings | ₹0 |

| Player will get | ₹5,000 |

No TDS will be deducted when there are no positive net winnings.

What happens when a player makes multiple withdrawals and deposits in a financial year?

Let us understand this with the help of a few examples of what happens when a player makes 2 or more withdrawals in a financial year.

Scenario 1: When Net winnings increase in the financial year.

FY Opening Balance: ₹5,000

The player deposits ₹3,000 on 5th April 2023.

1st withdrawal made on 20th May 2023 is as follows:

| Withdrawal 1 (A) | ₹10,000 |

| Deposit made (B) | ₹3,000 |

| FY Opening Balance (C) | ₹5,000 |

|

Net Winnings (A − B − C) |

₹2,000 |

| 30% TDS on Net Winnings | ₹600 |

| Player Received | ₹9,400 |

The player deposits ₹2,000 on 10th June 2023.

The player places a 2nd withdrawal request for ₹5,000 on 5th

July 2023.

| Total Withdrawal (A) (₹10,000 + ₹5,000) | ₹15,000 |

| Total Deposit (B) (₹3,000 + ₹2,000) | ₹5,000 |

| FY Opening Balance (C) | ₹5,000 |

|

Net Winnings (A − B − C) |

₹5,000 |

| 30% TDS on Net Winnings | ₹1,500 |

| TDS Paid Already | ₹600 |

| TDS Deduction on 2nd Withdrawal | ₹900 |

| Player Received | ₹4,100 |

In this case, TDS as per current Net Winnings is ₹1,500. But the

player has already paid ₹600 in the last withdrawal. Hence, only

the balance TDS of ₹900 will be deducted.

That is why the player gets ₹4100 in the account after TDS

deduction.

Scenario 2: When the player’s Net Winnings decrease in the financial year.

FY Opening Balance: ₹5,000

The player deposits ₹3,000 on 5th April 2024.

1st withdrawal made on 20th May 2024 is as follows:

| Withdrawal 1 (A) | ₹10,000 |

| Deposit made (B) | ₹3,000 |

| FY Opening Balance (C) | ₹5,000 |

|

Net Winnings (A − B − C) |

₹2,000 |

| 30% TDS on Net Winnings | ₹600 |

| Player will receive | ₹9,400 |

The player deposits ₹7,000 on 10th June 2024.

The player wants to make a 2nd withdrawal of ₹4,000 on 5th July

2024.

| Total Withdrawal (A) (₹10,000 + ₹4,000) | ₹14,000 |

| Total Deposit (B) (₹3,000 + ₹7,000) | ₹10,000 |

| FY Opening Balance (C) | ₹5,000 |

|

Net Winnings (A − B − C) |

-₹1,000 |

| 30% TDS on Net Winnings | 0 |

| TDS Deduction on 2nd Withdrawal | ₹0 |

| Player will get | ₹4,000 |

Since the player’s Net Winnings have decreased, no TDS will be deducted from this withdrawal.

Note - This is a case of excess TDS paid on previous withdrawal.

In the above example,

TDS paid on 1st withdrawal = ₹600

TDS liability on 2nd Withdrawal (based on current Net Winnings)

= ₹0

Excess TDS paid = ₹600

Note - There are 2 ways to claim back any excess TDS paid:

- Players can claim a refund from the Income Tax Department while filing ITR.

- Players can make tax-free withdrawals as long as their tax liability does not exceed the amount of excess tax they have already paid.

In the case of the above example,

The player can withdraw up to ₹2000 tax-free, i.e. without

paying any TDS. (30% TDS on ₹2000 = ₹600)

Financial Year-End Settlement

Suppose a player has some balance (deposit balance +

withdrawable balance) in the account at the end of the financial

year, i.e. 31st March. In that case, TDS will be deducted from

that amount by considering the whole amount as a withdrawal for

that financial year.

A player’s TDS liability will not be carried forward to the next

financial year. The closing balance in a player’s account after

the TDS settlement will become the Opening Balance for the next

financial year.

Total Withdrawal = Withdrawals made in the FY + Account balance

on 31st March.

Net Winnings = Total Withdrawal − Total Deposit − FY Opening

Balance

Net Winnings from which TDS has already been deducted will not

be considered for the final settlement.

Let us understand this with a few examples:

Opening Balance (on 1st April 2024): ₹5,000

Closing Balance (on 31st March 2025): ₹15,000

Withdrawals in FY: ₹0

Total Withdrawal (Closing account balance) = ₹15,000

| Total Withdrawal (A) | ₹15,000 |

| Total Deposit (B) | ₹5,000 |

| FY Opening Balance, on 1st April (C) | ₹5,000 |

|

Net Winnings on 31st March 2024 (A − B − C ) |

₹5,000 |

| 30% TDS Deduction | ₹1500 |

₹1500 will be deducted from the total account balance on

31st March 2025.

₹13,500 will be carried forward as the player’s Opening

Balance on 1st April 2025 for the new financial year.

Opening Balance (on 1st April 2024): ₹5,000

Closing Balance (on 31st March 2025): ₹5,000

Withdrawals in FY: ₹20,000

TDS already paid during FY = ₹1,500

Total Withdrawal (Withdrawals in FY + Closing Balance) =

₹20,000 + ₹5,000 = ₹25,000

| Total Withdrawal (A) | ₹25,000 |

| Total Deposit (B) | ₹10,000 |

| FY Opening Balance, on 1st April (C) | ₹5,000 |

|

Net Winnings (A - B - C) |

₹10,000 |

| 30% TDS on Net Winnings (D) | ₹3,000 |

| TDS Already Paid (E) | ₹1,500 |

| Final Settlement TDS Due (D - E) | ₹1,500 |

₹1500 will be deducted from the player’s wallet on 31st

March 2025.

₹3,500 will be carried forward as the Opening Balance on

1st April 2025.

Opening Balance (on 1st April 2024): ₹5,000

Closing Balance (on 31st March 2025) ₹5,000

Withdrawals in FY ₹15,000

TDS already paid during FY = ₹1,500

Total Withdrawals (withdrawals + closing balance) =

₹15,000 + ₹5,000 = ₹20,000

| Total Withdrawals (A) | ₹20,000 |

| Total Deposits (B) | ₹10,000 |

| FY Opening Balance, on 1st April (C) | ₹5,000 |

|

Net Winnings (A - B - C) |

₹5,000 |

| 30% TDS on Net Winnings | ₹1,500 |

| TDS Paid Already | ₹1,500 |

| Final Settlement TDS Due (D - E) | ₹0 |

No TDS will be deducted from the player’s account balance

on 31st March 2025.

₹5,000 Closing Balance will be carried forward as the

Opening Balance on 1st April 2025.

Opening Balance (on 1st April 2024): ₹5,000

Closing Balance (on 31st March 2025): ₹2,000

Withdrawals in FY: ₹15,000

TDS already paid during FY = ₹1,500

Total Withdrawal (withdrawals + closing balance) = ₹15,000

+ ₹2,000 = ₹17,000

| Total Withdrawals (A) | ₹17,000 |

| Total Deposits (B) | ₹15,000 |

| FY Opening Balance, on 1st April (C) | ₹5,000 |

|

Net Winnings (A - B - C) |

-₹3,000 |

| 30% TDS on Net Winnings | ₹0 |

| TDS Paid Already | ₹1,500 |

No TDS will be deducted from the player’s account balance

on 31st March 2025. ₹2,000 Closing Balance will be carried

forward as the Opening Balance on 1st April 2025.

In this case, TDS liability on 31st March = ₹0 Excess TDS

Paid = ₹1,500

The player will have to claim a TDS refund from the Income

Tax Department at the time of filing ITR.

Prizes other than Cash

When a player wins non-cash prizes of real value (white goods)

like cars, motorbikes, gadgets, etc, the player will have to pay

30% TDS to Junglee Ludo before receiving the prize.

Junglee Ludo will remit/pay the TDS to the government on the

player’s behalf and issue the player a TDS certificate.

Things to Remember :

- PAN verification is mandatory for making any withdrawal.

- Players will get a TDS certificate for tax filing after the quarter ends.

- Players can check the Tax Sheet in the ”Profile” section of Rummy.com.

-

Frequently Asked QuestionsWhat is TDS?

TDS means tax deducted at source.

According to income tax rules, a person/organization that is liable to make a payment of specified nature to any other person shall deduct tax at source and remit/pay the amount into the account of the Government of India. A TDS certificate is issued by the person/organization that deducts the tax at source.What are the applicable TDS rates?TDS is deducted at the rate of 30% from net winnings.

Has there been a change to the calculation of Net Winnings?Yes, a new rule for Net Winnings calculation was introduced by the Government of India in the financial year 2023-24, which is still applicable.

What changed in the Net Winnings calculation with the introduction of the new rule?Previously, Net Winnings were calculated as Total Winnings − Total Losses. Now, Net Winnings are calculated as Total Withdrawals − Total Deposits − Opening Balance.

Why do I have to pay TDS if my income threshold as per the new/old tax regime is not getting crossed?The tax liability on game winnings is calculated at the rate of 30% irrespective of the player’s income threshold. Your tax liability for the rest of your income is calculated as per the income tax slabs and deductions. Please consult your tax advisor for more information.

I have already provided my Aadhaar. Why is PAN needed?PAN is needed to issue a TDS certificate, which can be used for filing ITR and claiming a refund (if any).

What if I don’t have a PAN?You will be unable to withdraw money if your PAN is not linked to your Junglee Ludo account.

Where do I get the TDS certificate from?You will receive your TDS certificate from Junglee Ludo 45 days after the end of a financial quarter.

I see different amounts getting deducted from each withdrawal. What is the logic for TDS calculation?The TDS is deducted based on 5 parameters: Net winnings, total withdrawals, total deposits, opening balance at the start of the financial year, and TDS already paid on previous withdrawals. Depending on your Net Winnings at the time of withdrawal, 30% TDS is deducted from the withdrawal amount. You can always check the details in the Tax Sheet in the “Withdrawals” section.

How can I check if the TDS deducted from my winnings has been paid to the government?You will receive your TDS certificate from Junglee Ludo 45 days after the end of a financial quarter. This TDS certificate will show the tax paid to the government on your behalf.

What will happen to the excess tax paid?You can claim back any excess TDS paid by filing an ITR return. Junglee Ludo will provide you with a TDS certificate within 45 days of the quarter's end for the purposes of filing ITR.

Will I get a refund from Junglee Ludo?No. Any excess tax paid will be refunded to the player by the Government of India after the player files an ITR. Junglee Ludo has no legal authority or liability to refund any TDS paid.

What will happen to the balance in my Junglee Ludo account at the end of the financial year (31st March)?Your account balance as on 31st March will be added to your Total Withdrawal to calculate your Net Winnings for the financial year. There can be any one of the following 2 scenarios:

-

1. Net Winnings: Net Winnings > ₹0

30% TDS will be deducted from your Net Winnings. The remaining account balance will be carried forward as the opening balance for the next financial year and will be tax-free. -

2. Negative Net Winnings: Net Winnings ≤ ₹0

No TDS will be deducted. The entire account balance will be carried forward as the opening balance for the next financial year and will be tax-free.

-

1. Net Winnings: Net Winnings > ₹0